California’s housing market just hit the brakes — at least a little. According to Zillow, the Golden State’s total home value dropped by $106 billion over the past year, bringing the statewide total to $10.8 trillion. That may sound dramatic, but it’s only about a 1% dip. For context, the rest of the U.S. actually gained $862 billion in home value during the same period.

So, what does this mean for San Diego homeowners and buyers? Let’s break it down.

Statewide Perspective: A Rare Decline

California still makes up a huge chunk of the nation’s housing market — about 20% of the $55.1 trillion total. But affordability remains the state’s Achilles’ heel. Only 15% of California households can comfortably afford a typical home, compared with 34% nationally.

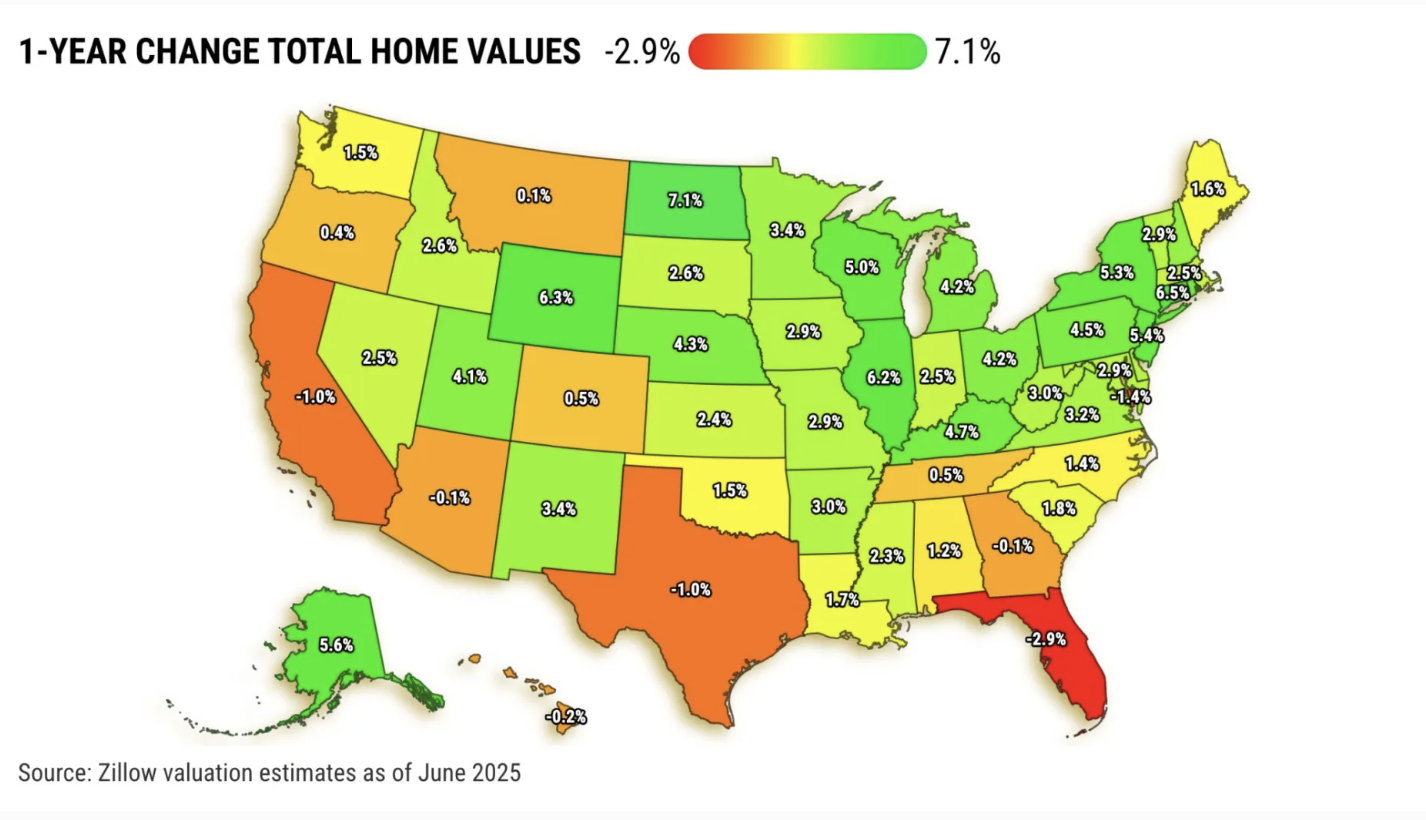

Other states saw sharper declines. Florida lost 2.9% in value, while Texas slipped 1%. On the flip side, places like New York and New Jersey gained big, proving that the slowdown is far from universal.

It’s worth noting: even with this recent dip, California homes are still up by $3.4 trillion since early 2020. That pandemic-era surge is the reason affordability is still such a challenge today.

San Diego Snapshot: First Price Drop in Two Years

Here in San Diego, prices are finally showing some weakness after years of relentless growth. According to the Case-Shiller Index, home values are down 0.61% year-over-year, marking the first decline since June 2023.

Meanwhile, Attom Data reports that the median price for a single-family home in San Diego County is $1 million. Homes are averaging about 19 days on the market before going pending, and nearly half of all homes sold in May went for below asking price. In other words, buyers now have more room to negotiate than they did a year or two ago.

What’s Ahead for 2025 and 2026

Forecasts suggest San Diego is in for a period of mild correction rather than a dramatic crash:

- Zillow projects a 1.5% decrease in home values by June 2026, with the biggest dip likely in late 2025.

- The National Association of Realtors predicts home sales nationwide will pick up in 2026 as mortgage rates ease, which could stabilize San Diego’s market.

The bottom line from experts? Prices may soften in the short term, but San Diego’s strong job market, desirable lifestyle, and tight inventory make a major collapse unlikely.

What This Means for Buyers and Sellers

For buyers, this shift could finally offer a bit of breathing room. With more inventory and longer selling times, you may have more leverage when it comes to negotiations.

For sellers, realistic pricing is key. Overpricing in this environment could mean your home sits on the market while buyers shop around for better deals.

Final Thoughts

San Diego’s housing market is adjusting, not collapsing. Prices are expected to dip modestly through 2025 before leveling out or even rebounding in 2026, especially if mortgage rates come down. Long term, the fundamentals still point to strength.

Get in contact with Bern today if you want to learn more or if you have any questions.