The California housing market has long been a symbol of both opportunity and inequality. While the Golden State is not the top destination for real estate investors nationally, the influence of investor ownership is still deeply felt across the state—especially as affordability continues to slip further out of reach for everyday Californians.

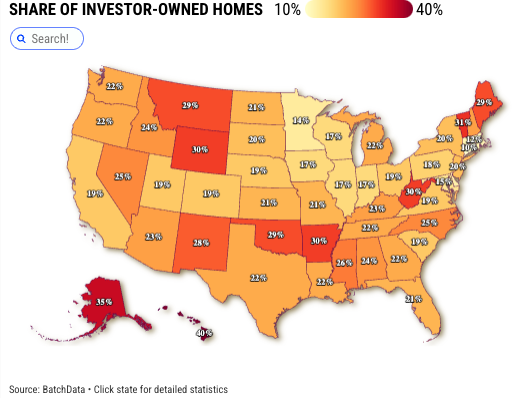

Recent data reveals that 19% of single-family homes in California are owned by investors, according to BatchData, a real estate analytics firm. That’s nearly 1.45 million homes statewide. On the surface, this puts California at No. 36 in the nation for investor share—seemingly a modest number. But context matters.

Due to its sheer size, California ranks second nationally in total investor-owned homes, just behind Texas. And in specific counties like San Diego, investor activity is even more pronounced: nearly 24% of homes sold in the second quarter of 2024 were bought by investors, according to Redfin. That’s the second-highest rate in the country, behind only Miami.

Why Are Investors So Interested in California?

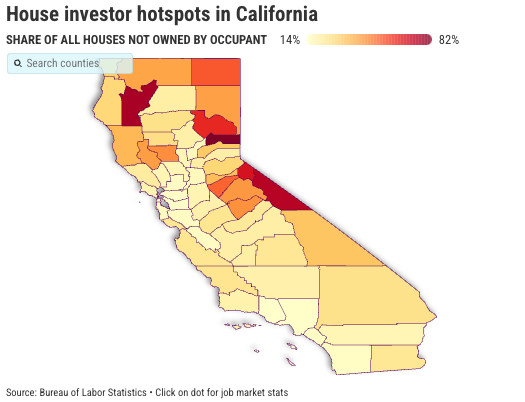

Despite high prices—California has the third-highest median home price in the nation at $866,100—investors are still active. Some are drawn by long-term value, others by tourism appeal or short-term rental opportunities in vacation-heavy areas. For example, in counties like Sierra, Trinity, and Mono, more than half of all homes are owned by investors, often used as vacation homes or rental properties.

While major headlines often focus on Wall Street-backed corporations, it’s important to note that 91% of investor-owned homes in California are held by small-scale landlords with five or fewer properties. These mom-and-pop investors are often more locally rooted—but they still compete in the same housing pool as families looking to buy their first home.

The Impact on Families and First-Time Buyers

The consequences of investor activity aren’t just about market data—they’re felt every time a family loses out on a bid to an all-cash offer or is priced out of their own neighborhood. Investors, especially institutional buyers, often have access to more capital, fewer contingencies, and faster timelines—making it difficult for regular buyers to compete.

In places like San Diego, this has created a frustrating paradox. As one local broker put it, investor activity signals strong long-term confidence in the market—but it also worsens the homeownership gap, especially for younger and lower-income buyers.

That gap is especially pronounced in California, where 45% of residents rent their homes, the third-highest rate in the country. And with rising prices and limited inventory, renting isn’t always a temporary stepping stone—it’s becoming a long-term reality.

Not All Investors Are the Same—But the Effects Are Widespread

Public officials like San Diego County Supervisor Terra Lawson-Remer have pointed out the difference between local landlords and large, private equity firms. While many small landlords take pride in maintaining their properties and building community relationships, larger institutional investors often prioritize profits—sometimes leading to rent hikes, reduced maintenance, and tenant displacement.

Still, even well-intentioned investment contributes to a structural issue: homes are increasingly treated as assets first, and shelter second. When nearly one in five houses is used for rental income, vacation stays, or long-term appreciation, the pool of attainable homes for actual residents shrinks—especially in already tight markets.

Looking Ahead

Investor ownership in California may not be the highest in the nation, but its impact is outsized—particularly in high-demand regions like San Diego, Los Angeles, and the Central Valley. And while there’s no simple solution, the data invites bigger questions: How do we balance investor confidence with community stability? How do we ensure that families have a fair shot at homeownership?

For many Californians, the dream of owning even one home feels increasingly out of reach. And as long as investors—large and small—have the power to buy homes in bulk, that dream will remain a competitive one.