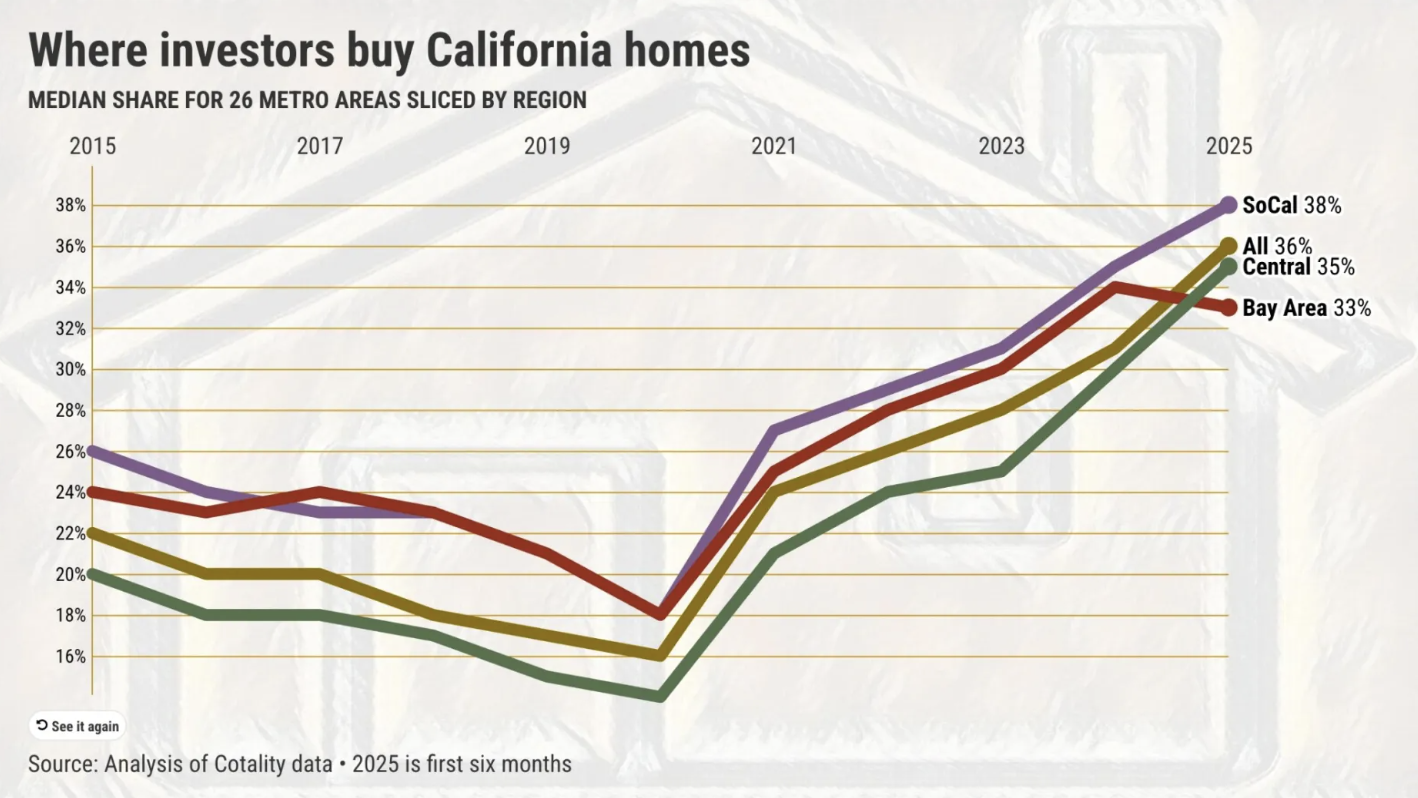

California’s housing market is tough enough for regular buyers, but add investors into the mix and things get even harder. In 2025’s first half, 36% of all home purchases in California were made by investors—that’s more than 1 in 3 homes.

To put that in perspective, investor activity was only 16% at the low point in 2020. In just a few years, their share has more than doubled, reshaping the playing field for everyone else.

So where are these investors buying, and how does their presence affect first-time homebuyers? Let’s dig in.

Why Investors Are Buying More

Investors, big and small, have the one advantage most first-time buyers don’t: cash and financial leverage. With California’s affordability near historic lows—only 15% of households statewide qualify for a typical home—investors are often the ones swooping in when regular buyers can’t compete.

For many investors, housing is a numbers game. They’re betting on long-term appreciation, rental income, or both. But their growing presence means fewer homes for families trying to break into the market.

Where Investors Are Buying

Surprisingly, most of California’s investor hot spots aren’t along the coast. Instead, they’re inland—where homes are (relatively) more affordable and profit margins can be higher.

Here are some standouts:

- San Jose: Investors averaged 47% of all single-family purchases in the last 18 months (up from 27%). That’s nearly half the market dominated by investors.

- Los Angeles/Orange County: Investors claimed 43% of purchases, up sharply from 29%.

- El Centro: The state’s biggest surge, jumping from 19% investor share to 40%.

- San Diego: Investors made up 37% of buyers, up from 25%.

- Central Valley cities (Fresno, Visalia, Merced, Modesto, Stockton, Bakersfield): All saw investor shares climb into the 30–36% range, nearly doubling their presence compared to the last decade.

In short: investors are buying everywhere, but they’re especially active in places where middle-class families once had a fighting chance at affordability.

Small vs. Mega Investors

Not all investors are the same. In fact, the mix is shifting.

- Small investors (fewer than 10 homes) still make up the largest group, but their share of investor purchases dropped from 63% to 46%.

- Medium investors (10–99 homes) ticked up slightly, from 24% to 25%.

- Large investors (100–999 homes) grew from 13% to 18%.

- Mega investors (1,000+ homes) jumped the most, from 3% to 11%.

That means institutional players are growing in power, edging out mom-and-pop landlords who used to dominate the rental market.

How This Impacts First-Time Homebuyers

Here’s the double-edged sword:

- Hurts Buyers: Investors drive competition, pushing prices higher and making it nearly impossible for first-time buyers with limited savings to compete. Cash offers from investors often beat out FHA- or VA-backed loans. Plus, homes that might have gone to families instead become rentals, keeping people locked in as tenants.

- Helps the Market (Sometimes): Investors provide stability when regular buyers pull back. If investors disappeared tomorrow, prices might tumble, which sounds good for affordability—but it would also create ripple effects, slashing homeowner equity and destabilizing lending markets.

For now, though, the scales are clearly tilted. When more than one-third of California homes are going to investors, first-time buyers face an uphill battle.

The Big Picture

California has always been a competitive market, but the surge in investor activity has made it harder than ever for everyday buyers to grab a piece of the American Dream.

With affordability already at rock bottom, the rise of investors—especially large institutional players—raises tough questions: Should California welcome this demand as a stabilizer, or should policymakers step in to give first-time buyers a fairer shot?

Either way, the message is clear: in today’s market, the biggest competition for first-time buyers isn’t just other families—it’s investors with deeper pockets.