When it comes to California housing, renters and homeowners often feel like they’re living in the same storm—just in different boats. Both groups are being squeezed harder than the national average, with housing costs swallowing large chunks of household income. But the way these struggles play out differs depending on whether you’re paying rent or a mortgage.

Let’s break it down.

The Shared Struggle

Whether you rent or own, California is one of the toughest places in the nation to afford a roof over your head. Across the state, housing costs regularly push families past the “burdened” threshold—when monthly expenses exceed 30% of income—and in many cases, into extreme financial stress at 50% or more.

The data shows just how heavy the load is:

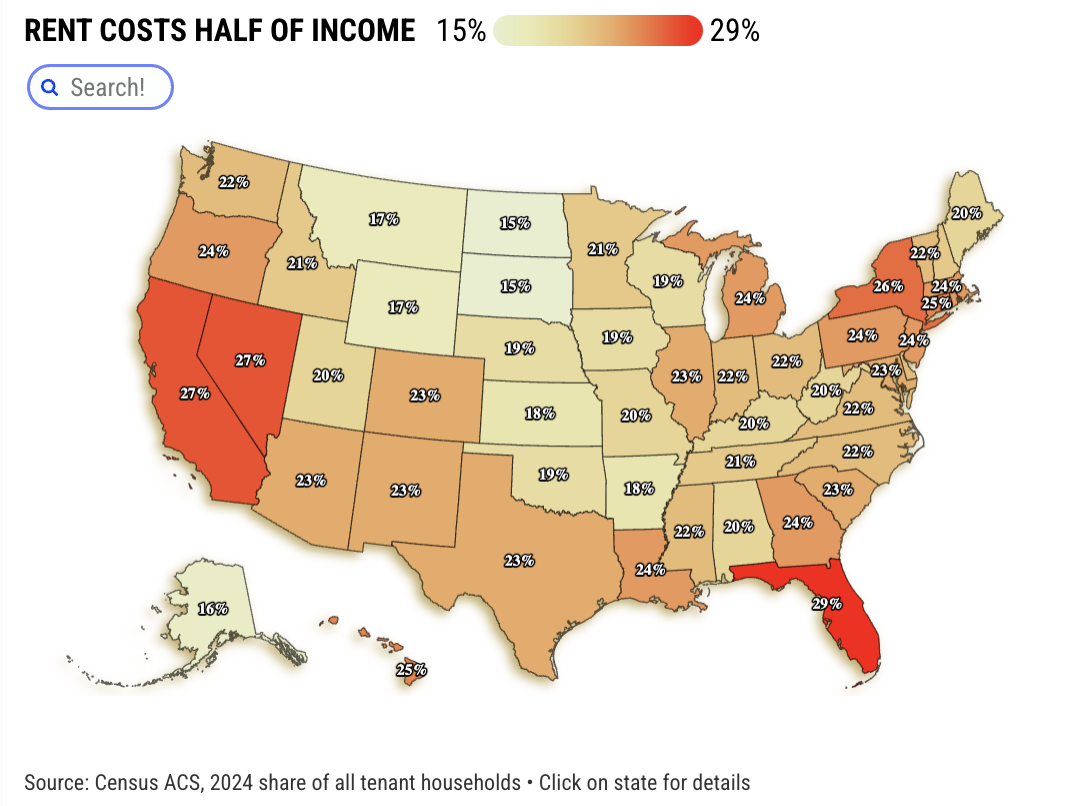

- For renters, 27% of California tenants spend more than half their income just on rent and utilities.

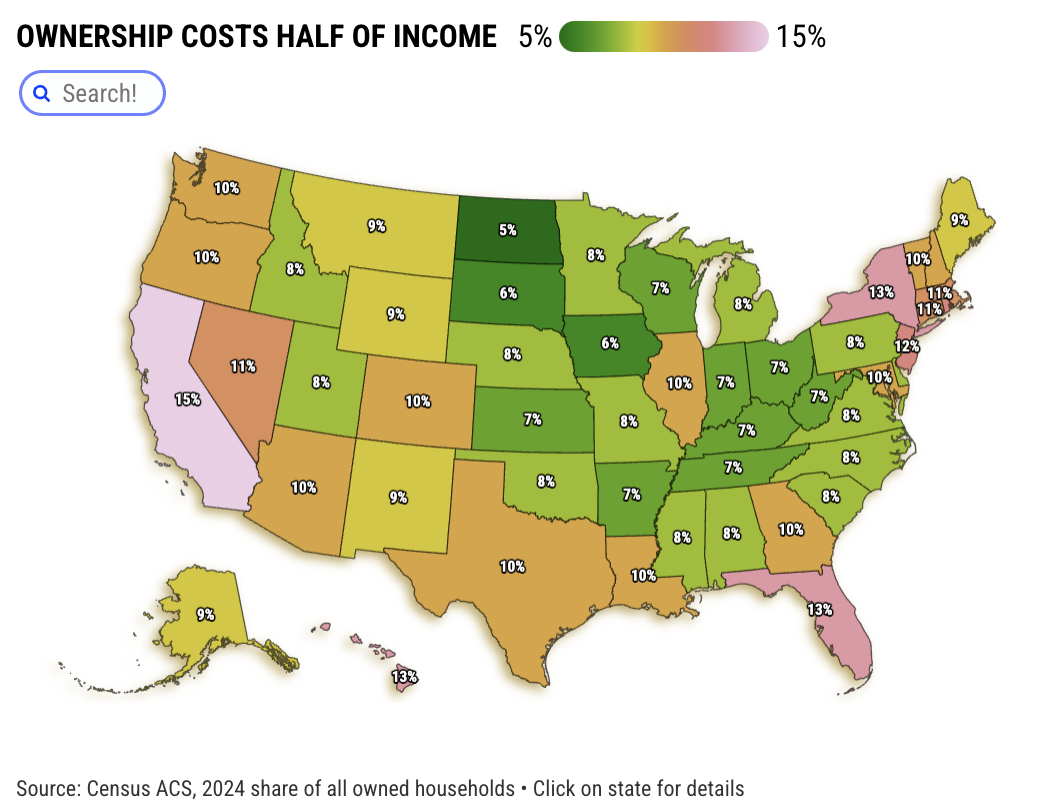

- For homeowners, 15% face the same 50%-plus burden, the highest rate in the country.

These percentages may look different, but the bottom line is the same: whether renting or owning, a huge share of Californians are financially underwater just trying to keep their homes.

Renters’ Reality: Paying More, Getting Less

Renters have it especially tough. The median rent in California hit $2,104 a month in 2024—60% higher than the U.S. average of $1,319. That makes California the most expensive rental market in the country.

Add in the fact that rent prices jumped 30% since 2019, and it’s no surprise that 1.6 million California renters are now “extremely burdened,” meaning they’re handing over more than half their paychecks to landlords.

To put it in perspective: California has 13% of the nation’s rental households, but accounts for 15% of the most rent-stressed tenants in America.

And unlike homeowners, renters aren’t building equity while they struggle—every dollar gone is a dollar they’ll never see again.

Homeowners’ Headache: The Cost of “Owning”

Owning a home is no easier. California homeowners pay a median of $2,280 a month in recurring costs, from mortgages and taxes to insurance and HOA dues. That’s 70% higher than the U.S. average of $1,340, and second only to Washington, D.C.

Here’s the kicker: 1.1 million California homeowners spend more than half their income on ownership costs—the largest number of any state. Even with historically low mortgage rates during the pandemic, rising property taxes, skyrocketing insurance, and inflated utility bills have erased much of that relief.

And while some owners have no mortgage at all (about one-third of Californians), they’re not immune. Property taxes and insurance premiums alone can crush household budgets, especially after the 23% statewide increase in ownership costs since 2019.

Two Paths, Same Destination

Renters and owners may face different bills, but the pressure points lead to the same place: financial strain. Renters are dealing with relentless price hikes and no wealth-building upside, while homeowners juggle massive monthly costs that often feel more like a liability than an asset.

California might be the land of sunshine and opportunity, but when it comes to housing, it’s also the land of sacrifice. For millions of residents, the dream of stable, affordable housing feels further away than ever.