San Diego has always been seen as an idyllic place to live. With its year-round sunshine, beautiful coastline, and vibrant communities, it’s no surprise people want to put down roots here. But as housing prices continue to climb and affordability plummets, a growing number of San Diegans are left wondering: is it still possible to build a future here?

The Current Housing Picture

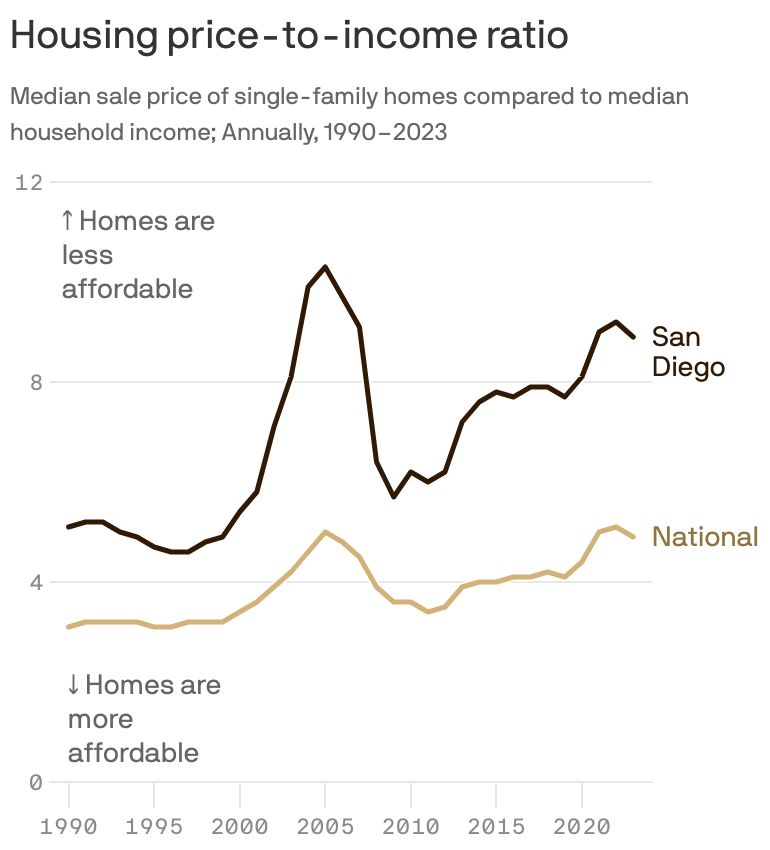

The numbers tell a sobering story. The median home price in San Diego County hovers around $900,000. With current interest rates, a buyer would need to earn approximately $258,000 annually to afford a typical home—nearly three times the region’s median household income. Only 15% of households in the county can meet that threshold. This growing affordability gap has pushed homeownership further out of reach for working and middle-class residents.

California as a whole reflects this trend. The state ranks second in the nation for housing costs and is now second-to-last in homeownership. While the national homeownership rate sits comfortably above 65%, California lags at just 44%. For many families, even those with stable jobs and long-term ties to the region, owning a home is no longer a realistic goal.

How We Got Here

San Diego’s housing crisis didn’t happen overnight. For decades, the region has struggled with a lack of housing supply due to restrictive zoning laws, community opposition to new development, high construction costs, and limited land availability. These barriers have prevented the city from keeping pace with population growth.

The COVID-19 pandemic added fuel to the fire. Remote work, record-low interest rates, and out-of-town buyers flooded the local market. Prices surged, and even as appreciation has slowed slightly, costs remain far above what most San Diegans can afford. Mortgage rates have also risen significantly, meaning that even if prices stabilize, the monthly cost of homeownership remains prohibitively high.

The Cost of Inaction

Affordability challenges impact more than just homebuyers. As fewer people are able to purchase homes, demand for rentals increases, driving up rents and contributing to housing insecurity. San Diego is also at risk of losing its workforce as teachers, healthcare workers, city employees, and small business owners are priced out of the communities they serve.

When families are forced to relocate, the ripple effects are widespread—less economic diversity, longer commutes, reduced school enrollment, and weakened community ties. The city’s character, vibrancy, and economic health all depend on a diverse population being able to live and thrive here.

What’s Being Done

Local and state officials have taken steps to address the crisis. California has passed legislation to encourage denser development, legalize accessory dwelling units (ADUs), and accelerate housing approvals near transit hubs. San Diego has explored reforms to encourage “missing middle” housing, such as duplexes and small apartment buildings, and has partnered with developers on affordable housing projects.

Still, many of these efforts are slow-moving or face resistance at the neighborhood level. Critics also point to broader issues, like the need for streamlining bureaucracy, prioritizing workforce housing, and rethinking how public land is used for housing. And despite all the reforms, home prices have continued to rise faster than income growth.

A Turning Point for San Diego

At its core, San Diego’s housing crisis is about more than numbers—it’s about values. Do we want to be a city where only the wealthy can afford to live? Or do we want to build a future where young professionals, families, and seniors can all find a place to call home?

Addressing this challenge will require bold policy changes, long-term investment, and community support for new housing options. It also means reimagining what local neighborhoods can look like and embracing solutions that serve the next generation—not just preserve the past.

The time to act is now. Because if we don’t, the people who make San Diego what it is may no longer be able to stay.